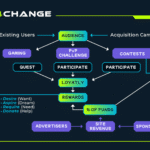

South Africa’s major banks are entering the “Next Era of Competition”, defined by the ability to harness customer data, deliver hyper-personalised products, and create seamless digital experiences.

For banks and financial institutions, succeeding in this new era isn’t just about technology, it’s about understanding customers on a deeper level and turning insights into engagement. This is where the CultureQuiz framework can make a real difference.

Turning Data into Actionable Insights

Banks that are able to leverage customer information responsibly will pull ahead. CultureQuiz helps achieve this by:

- Capturing sentiment and behavioural data through gamified quizzes, surveys, and polls.

- Providing actionable insights that reveal customer needs, preferences, and motivators.

- Supporting responsible data strategies, participation that builds digital trust.

Delivering Personalisation at Scale

It’s common knowledge banks are rapidly modernising core systems to launch products faster and meet growing customer expectations. CultureQuiz supports this by:

- Creating personalised engagement journeys that adapt to customer profiles and local markets.

- Seamlessly integrating with banking apps, loyalty programmes, and digital platforms.

- Rewarding participation with loyalty points, in-app credits, or other benefits, linking engagement directly to value.

Powering AI and Data Strategies

With AI reshaping the sector, from credit scoring to chatbots, banks need high-quality engagement data. CultureQuiz enhances this shift by:

- Providing structured engagement data into analytics and AI models for sharper insights.

- Providing dashboards for feedback and tracking of sentiment and customer trends.

- Complementing AI-driven customer journeys with interactive, human-centric touchpoints.

Building Digital Trust

We cannot stress enough that cyber security and trust remain the foundation of modern banking. CultureQuiz aligns with this by:

- Running on secure, cloud-based infrastructure with data privacy built in.

- Supporting compliance and regulatory alignment across regions.

- Maintaining customer confidence with anonymous participation.

Scaling Across Africa

With millions of clients now on digital platforms, banks are expanding across Sub-Saharan Africa. CultureQuiz enables scale by:

- Offering multi-language, ethnic sensitive design and content, and region-specific engagement features.

- Powering time-based competitions and leaderboards to drive participation and deep engagement.

- Allowing flexible branding and deployment, ensuring each roll-out feels native to the institution.

Conclusion

The Next Era of Competition will be won by banks and financial institutions that combine resilience, innovation, and customer-centric engagement. CultureQuiz provides the framework to:

✅ Unlock customer insights in detailed feedback reports and analysis

✅ Deliver on-point experiences

✅ Build trust while scaling across Africa

By integrating CultureQuiz into their digital ecosystems, banks and financial institutions can move beyond transactions into meaningful, data-driven engagement that secures long-term loyalty and growth.